Noticias y actualidad

En Nutresa siempre trabajamos por nuestro propósito y la mejor forma de mantenerte informado la encuentras aquí

Empresas de Grupo Nutresa, reconocidas como pioneras efr

El pasado 11 de abril, la Fundación Másfamilia anunció que ya son cien las empresas en Colombia certificadas como Empresa Familiarmente Responsable – EFR – y aprovechó el espacio para…

Ver contenidoTresmontes Lucchetti, galardonada en Chile como “Empresa Destacada en ASG”

En el marco de una nueva edición de la Premiación Empresarial que la consultora Ernst…

Ver contenido

Grupo Nutresa obtiene Grado de Inversión Internacional con una calificación de ‘BBB’ según Fitch Ratings

Fitch Ratings, agencia global de calificación crediticia, entregó a Grupo Nutresa el pasado lunes 8…

Ver contenido

Informe de Sostenibilidad 2023

En Nutresa trabajamos día a día por nuestro propósito superior “construir un mundo mejor donde el desarrollo sea para todos”, este define lo que somos, nuestra esencia y compromiso con las personas, el planeta y la prosperidad.

Consultar informe 2023Informe de Gestión 2023

Ver contenidoModelo de relacionamiento

Ver contenidoAnálisis de materialidad

Ver contenidoDesempeño de los Negocios

Ver contenidoObjetivos estratégicos

Ver contenidoSomos Un Futuro Entre Todos

Ver contenido

Estrategia

Gestión

Fundación

Estrategia

Gestión

Fundación

Estrategia

Gestión

Fundación

Estrategia

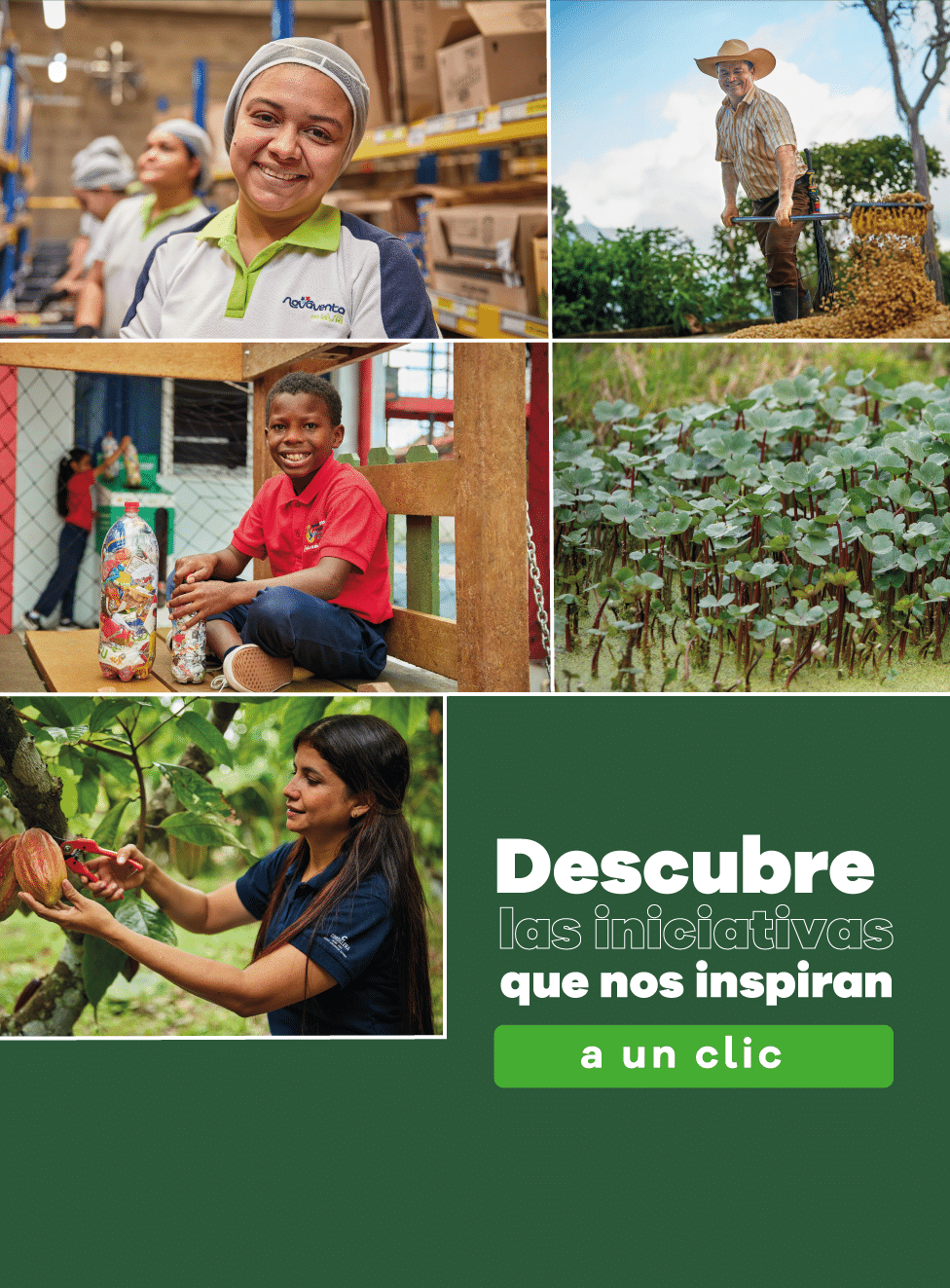

La conservación del capital natural y el progreso del capital social son nuestras prioridades y están directamente relacionadas con la capacidad de gestionar los negocios atendiendo las expectativas y las necesidades de nuestros grupos relacionados.

Leer másGestión

La sostenibilidad es el marco de actuación en nuestra empresa, y se fundamenta en la búsqueda del progreso de las personas a través del desarrollo integral de capacidades, la seguridad alimentaria y los negocios inclusivos.

Leer másFundación

Grupo Nutresa contribuye al desarrollo humano y territorial de los países donde opera para fortalecer el potencial de las personas, poniendo al servicio de la sociedad y de los aliados todo su conocimiento, prácticas y experiencias mediante la colaboración y la implementación de iniciativas pertinentes, eficaces y sostenibles.

Leer másTrabaja con nosotros

En Nutresa abrazamos la diversidad en todas sus formas y promovemos la equidad de género a partir del reconocimiento de las capacidades de todas las personas, en un ambiente incluyente y de respeto. Estamos convencidos que #ENTRETODOS somos el talento que construye futuro.

¡Sé parte de este #TalentosoEquipo!

Contáctanos

Contáctanos