Grupo Nutresa Valuation Kit – GNVK

Here you will find historical information and long-term strategic objectives of the Organization. Everything you need to know to value our Company.

Here you will find historical information and long-term strategic objectives of the Organization. Everything you need to know to value our Company.

click to see more

click to see more

Grupo Nutresa’s sales CAGR* over the past 20 years has been 10,85% which means the Company has multiplied 7,9 fold over this period.

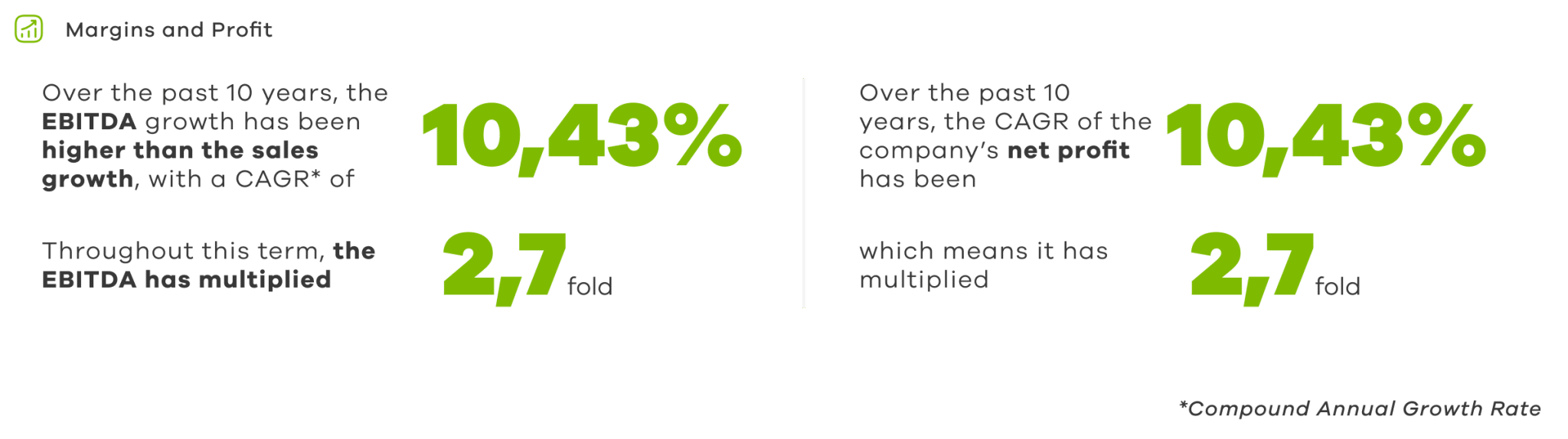

Over the past 10 years, the EBITDA growth has been higher than the sales growth, with a CAGR* of 10,43%. Throughout this term, the EBITDA has multiplied 2,7 fold.

Over the past 10 years, the CAGR of the Company’s net profit has been 10,32%, which means it has multiplied 2,7 fold

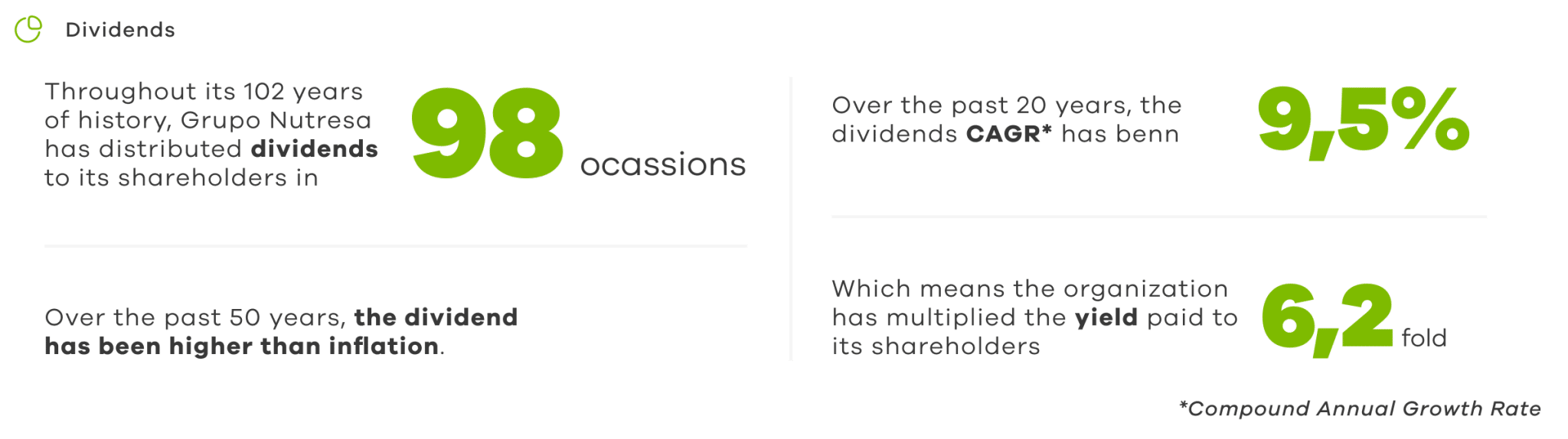

Throughout its 102 years of history, Grupo Nutresa has distributed dividends to its shareholders in 98 ocassions. Over the past 50 years, the dividend has been higher than inflation. Over the past 20 years, the dividends CAGR* has been 9,5%, which means the Organization has multiplied the yield paid to its shareholders 6,2 fold.

Over the past 5 years, Grupo Nutresa has generated cumulative operating cash flows of COP 3,3 trillion.

Select a topic of interest and download the report.

3Q25

3Q25

2Q25

1Q25 Historical Financial Statements

4Q24

2Q24 Historical financial Statements

1Q24 Historical financial Statements

4Q23 Historical Financial Statements

3Q23 Historical Financial Statements

2Q23 Historical Financial Statements

1Q23 Historical Financial Statements

4Q22 Historical Financial Statements

2Q24

1Q25

4Q24

3Q24

2Q24 Sales and EBITDA by Business Unit

1Q24 Sales and EBITDA by Business Unit

4Q23 Sales and EBITDA by Business Unit

3Q23 Sales and EBITDA by Business Unit

2Q23 Sales and EBITDA by Business Unit

1Q23 Sales and EBITDA by Business Unit

4Q22 Sales and EBITDA by Business Unit

Multiples and indicators: EV/EBITDA, P/E, Payout ratio, ROIC

Contact us

Contact us